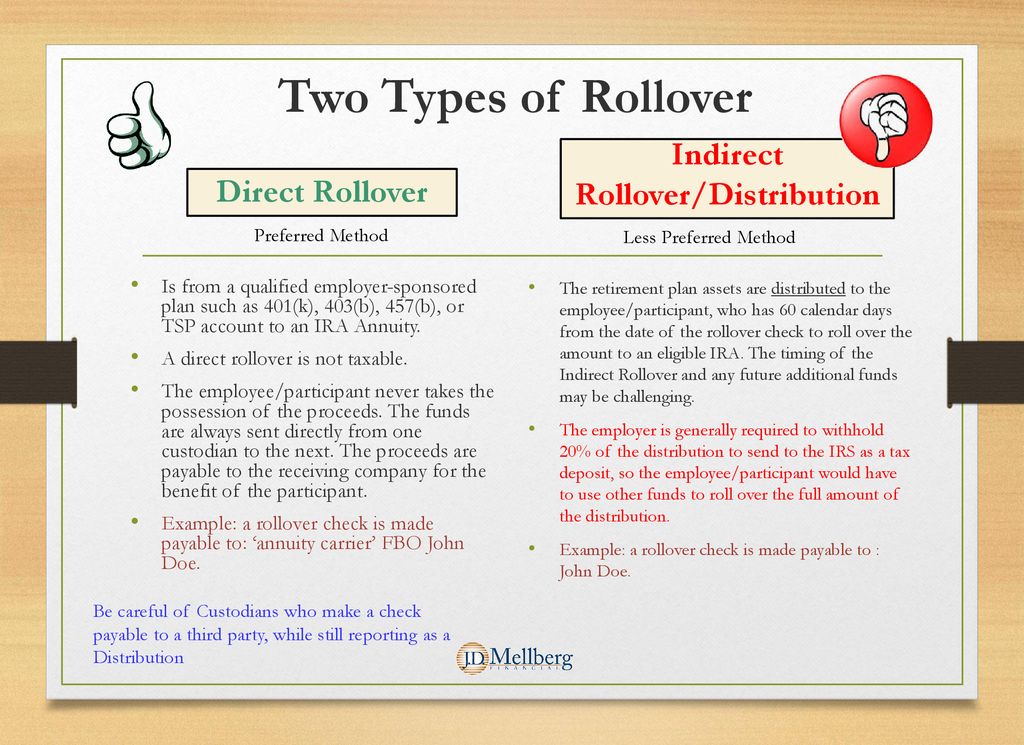

Under irs regulations a 401 k rollover occurs when you transfer all or some of your account to another qualified retirement plan such as a tax deferred ira annuity.

Can you rollover an annuity into a 401k.

Many insurance companies tout the tax benefits of annuities.

Learn how annuities and life insurance can properly fit into your financial plan.

Jordan will report 10 000 as a nontaxable rollover and 2 000 as taxes paid.

Qualified annuities are often set up by employers on behalf of their employees as.

We will accept both transfers and rollovers of tax deferred money from traditional iras simple iras and eligible employer plans such as a 401 k or 403 b into the traditional balance of your account.

Rolling some of your retirement savings from an ira or 401 k into an annuity can be a good way to replicate having a pension income to support your needs.

401 k plans even though annuities and 401 k plans both have tax.

We will accept only transfers i e direct rollovers of qualified and non qualified roth distributions from roth 401 k s roth 403 b s and roth 457 b s into the roth balance of your account.

The answer depends on how you own the annuity and whether your 401 k plan will accept it as a rollover asset.

Annuities funded with an ira or 401 k rollover are qualified plans enabling an insurance company to create an ira annuity into which you can deposit your retirement funds directly.

If jordan decides to roll over the full 10 000 she must contribute 2 000 from other sources.

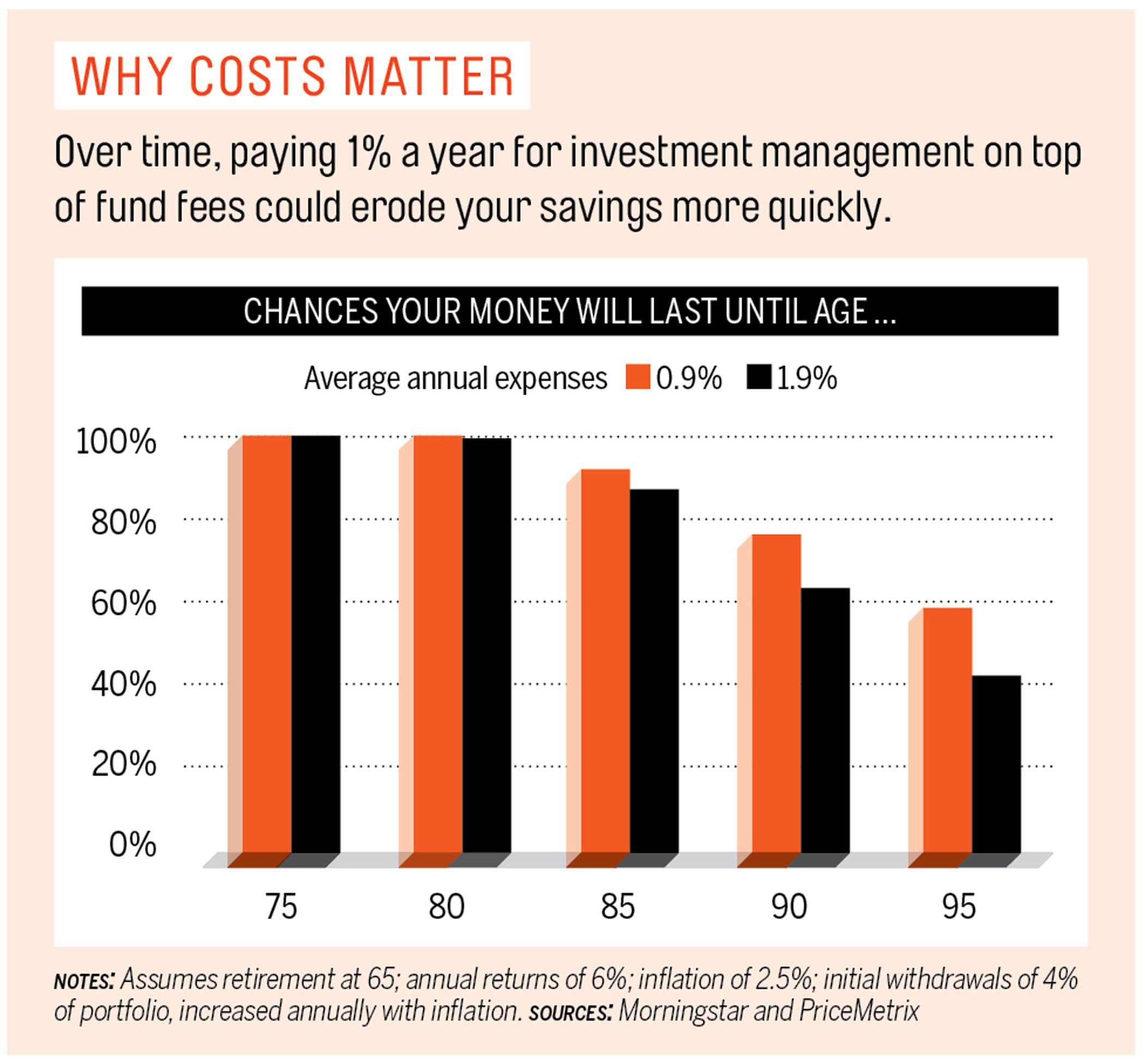

However a traditional 401 k is already tax sheltered and a delayed rollover could cost you in taxes.

If you roll over the full amount of any eligible rollover distribution you receive the actual amount received plus the 20 that was withheld 10 000 in the example above.

You can transfer your 401k to an annuity.

You can roll over your ira 401 k 403 b or lump sum pension payment into an annuity tax free.

This is because 401 k plan contributions are tax deductible while annuity contributions outside of a retirement account are not tax deductible.

-page-001_tcm113-118061.jpg)

:max_bytes(150000):strip_icc()/best_places_to_invest_your_down_payment_money-56a090b83df78cafdaa2c663.jpg)

:max_bytes(150000):strip_icc()/401k_folder-5bfc325d46e0fb00260c6585.jpg)