Also gain some knowledge about leasing experiment with other financial calculators or explore hundreds of calculators addressing other topics such as math fitness health and many more.

Capital equipment leasing interest rates.

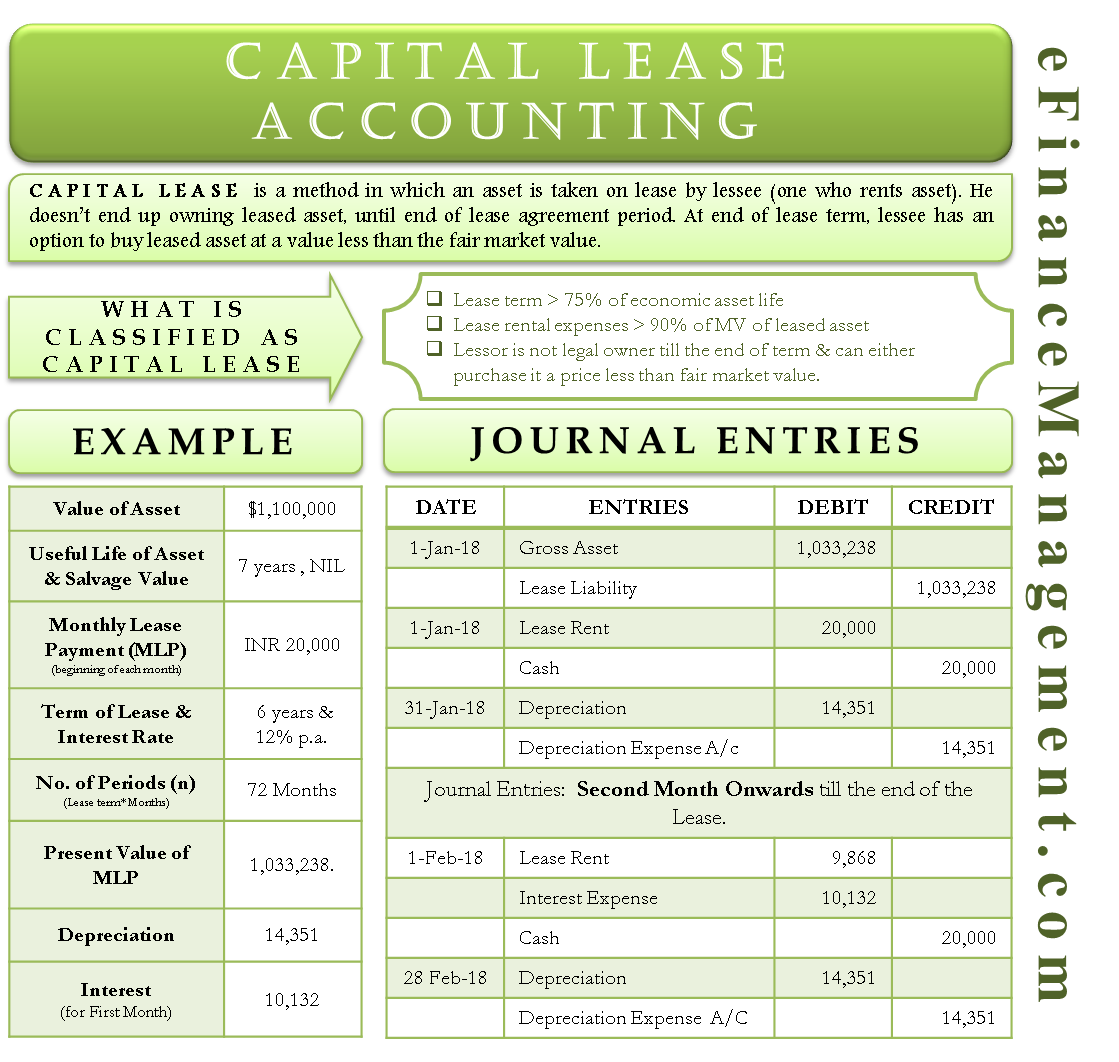

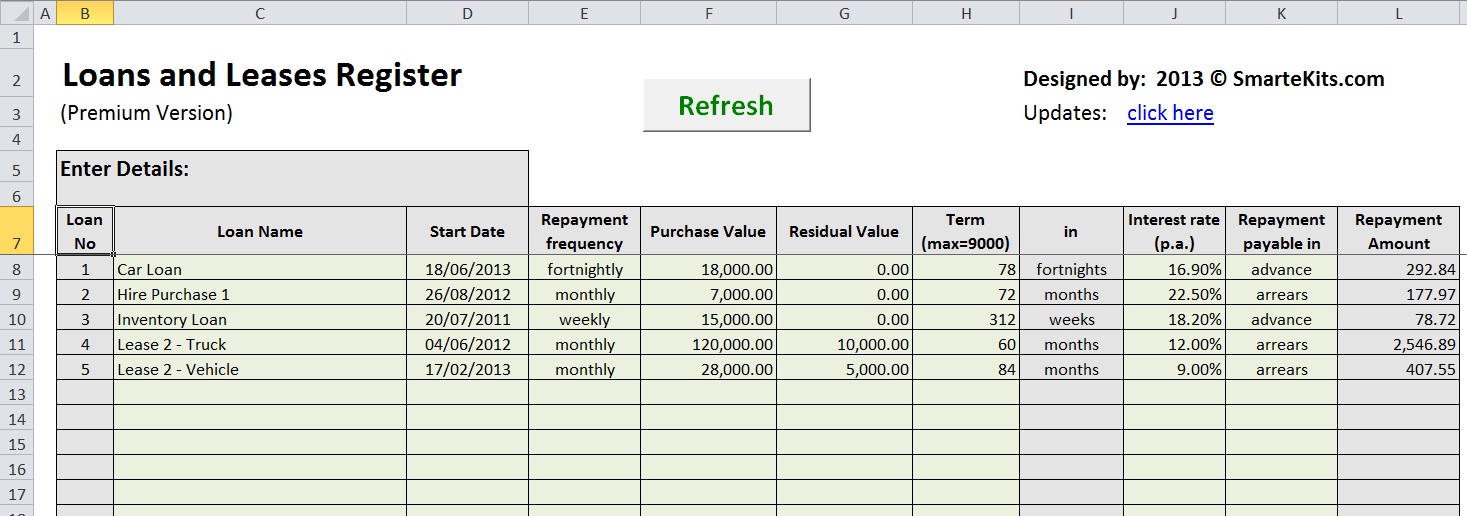

Let s assume that a company is leasing a vehicle.

Equipment priced less than 100 000 usually comes with a higher finance rate anywhere from 8 to 20.

Equipment leases mean you can get very expensive equipment in your business in rates that are much more manageable for businesses to pay.

This can make budgeting problematic depending on the size of.

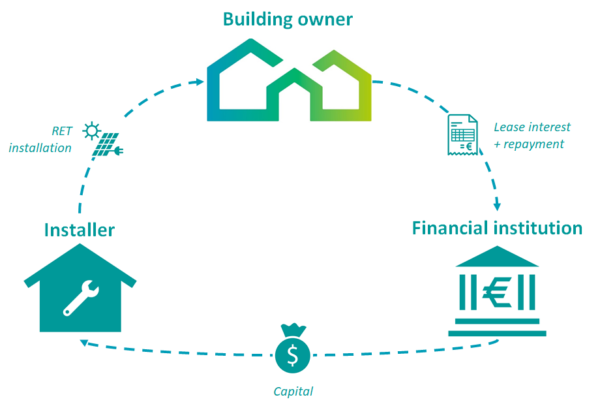

With a lease the manufacturer or the dealer of the equipment may provide the financing.

Special pro and put residuals on new and late model used 2015 or newer combines for a limited time only.

Special pro put and fpo residuals on new and used grain carts dump carts forage wagons dump wagons tillage equipment and heads cornheads drapers platforms.

Unlike a lease which provides fixed rate financing a loan or line of credit s interest rates may fluctuate throughout the loan term.

With leasing instead of dealing with interest rates or huge up front payments you pay a flat monthly rate with current capital equipment lease rates.

Current capital equipment lease rates businesses pay.

These kinds of capital equipment loans carry an interest rate anywhere between 6 and 12 with the rate largely dependent on the credit worthiness of the customer.

Equipment financing rates are determined based upon the size of the lease your credit score and payment history and where your business is located.

Lock in a low lease payment with agdirect s special lease residuals.

An example of calculating a capital lease interest rate.